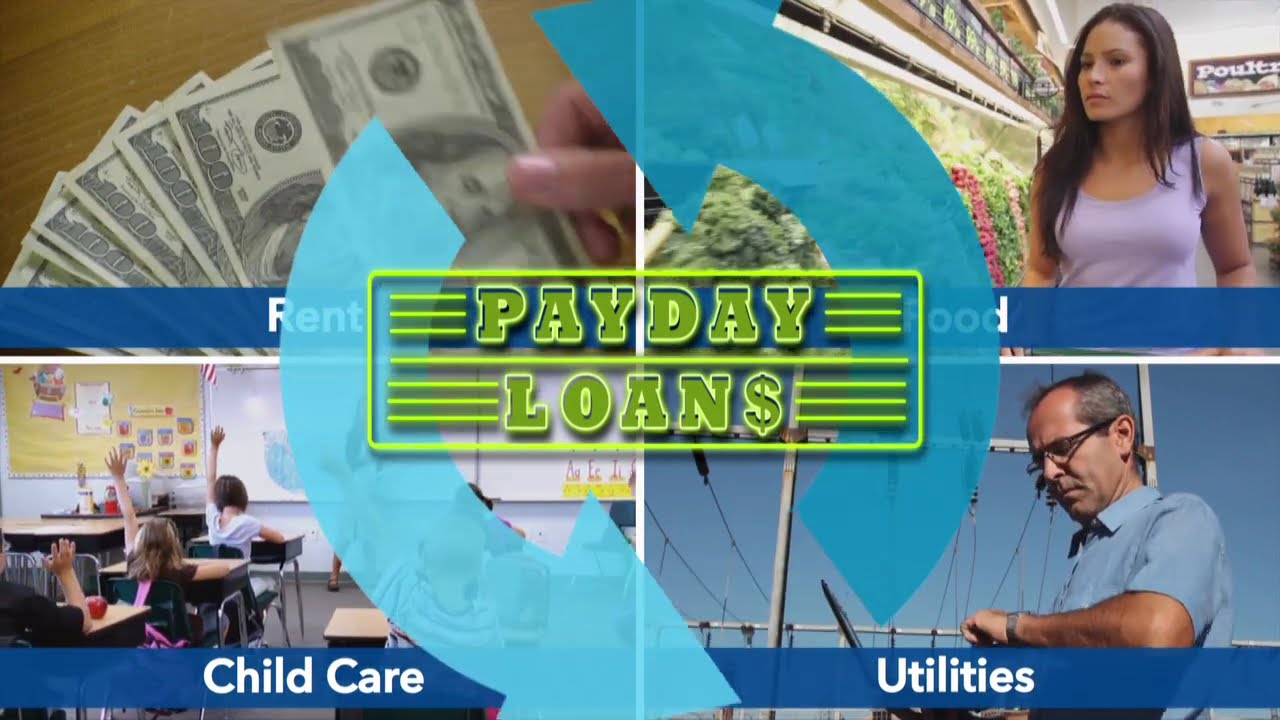

What Does Payday Loan Do?

Wiki Article

Everything about Quick Payday Loans Of 2022

Table of ContentsThe 6-Minute Rule for Quick Payday Loans Of 2022Quick Payday Loans Of 2022 for BeginnersNot known Incorrect Statements About Payday Loans More About Quick Payday Loans Of 2022

For a funding of $100+, 1 month for each multiple of $20 of cash loan. Differs widely depending on loan kind and quantity. Procurement charge can not exceed $1 for every single $5 of money advancement. Procurement fee can not exceed one-tenth of cash loan amount. Acquisition charges are separate from passion. Utah None Varies depending on rollover option.

Wisconsin None n/a No limitation on interest billed prior to maturity day of payday advance. Otherwise paid by maturity day, may bill passion at max of 2. 75% monthly. This adjustments if you have greater than 1 cash advance. Can't offer payday advance loan if consumer has greater than $1,500 or 35% of gross monthly revenue in cash advance.

This graph is current as of August 2019. To stay clear of predatory finances such as cash advance and auto title financings, there are basically 2 tracks you can take: The "I need money currently" alternatives to predatory lendings.

The Payday Loans Statements

The catch with this cash advance finance choice is you commonly have to be a participant of the credit rating union for at the very least one month before taking out this brief term funding. Payday Loans., with a cosigner, you can obtain access to an individual finance with much better rate of interest prices as well as develop your very own credit score history while you're at it.Ideally, a cosigner must be somebody who has wonderful credit. Just bear in mind, if you do not repay the financing, you would not only put the financial burden on your cosigner, you can also damage their credit score. (See even more concerning exactly how co-signers influence your credit rating.) So if you go this route, see to it you will certainly have the ability to repay the car loan as concurred.

That method, if you do experience monetary difficulty, such as job loss, clinical costs, unforeseen car fixings, etc, you'll be able to either borrow the cash with a high top quality finance item or bank card, or have actually the money conserved to cover what you need. Loans. Below are some strategies you can begin today to help stay clear of predative loans in Quick Payday Loans of 2022 the future.

Not known Details About Loans

Several on the internet banks now use rather high APYs at the very least contrasted to the nationwide standard and don't require a minimal down payment to open up a savings account. So you can begin an interest-bearing account with just a few bucks. Some financial institutions, like Ally, supply an APY of over 2%, while some larger nationwide financial institutions like Financial institution of America supply closer to 0.When you get a cost savings account with a higher APY, you can grow the money you do have in your financial savings faster.

When you're pinched for money, it can be alluring to fill in a five-minute application to obtain the cash you require through a payday car loan. The quickest method isn't constantly the best way, and also you could end up paying for that single "payday" financing for years to come. Prior to visiting the closest cash development shop, be certain to take some time to look over your other choices.

All material at Self is composed by seasoned factors in the money industry as well as assessed by a certified individual(s).

The Only Guide for Payday Loan

The finances are for percentages, as well as several states set a limit on cash advance loan dimension. $500 is a common lending restriction although limitations vary over and listed below this amount. A cash advance is generally repaid in a solitary settlement on the customer's next cash advance, or when earnings is gotten from an additional source such as a pension or Social Safety and security.

Some states do not have payday financing because these loans are not permitted by the state's legislation or because payday lenders have chosen refrain to organization at the rates of interest as well as costs permitted in those states. In states that do permit or regulate cash advance borrowing, you may have the ability to locate more details from your state regulator or state chief law officer .

Those defenses consist of a cap of 36 percent on the Military Interest Rate (MAPR) as well as various other restrictions on what lending institutions can bill for payday as well as other consumer lendings. Contact your local Court Supporter General's (JAG) workplace for more information regarding offering limitations. You can use the buzz Legal Help Workplace locator to find help.

Report this wiki page